Protection

Depending on your personal circumstances this is the most important aspect of financial planning. Protection policies provide you and your loved ones with peace of mind, safe in the knowledge that whatever the future may bring, financial security is guaranteed:

Life Cover

• Critical Illness Cover/Serious Ill Health CoverMortgages

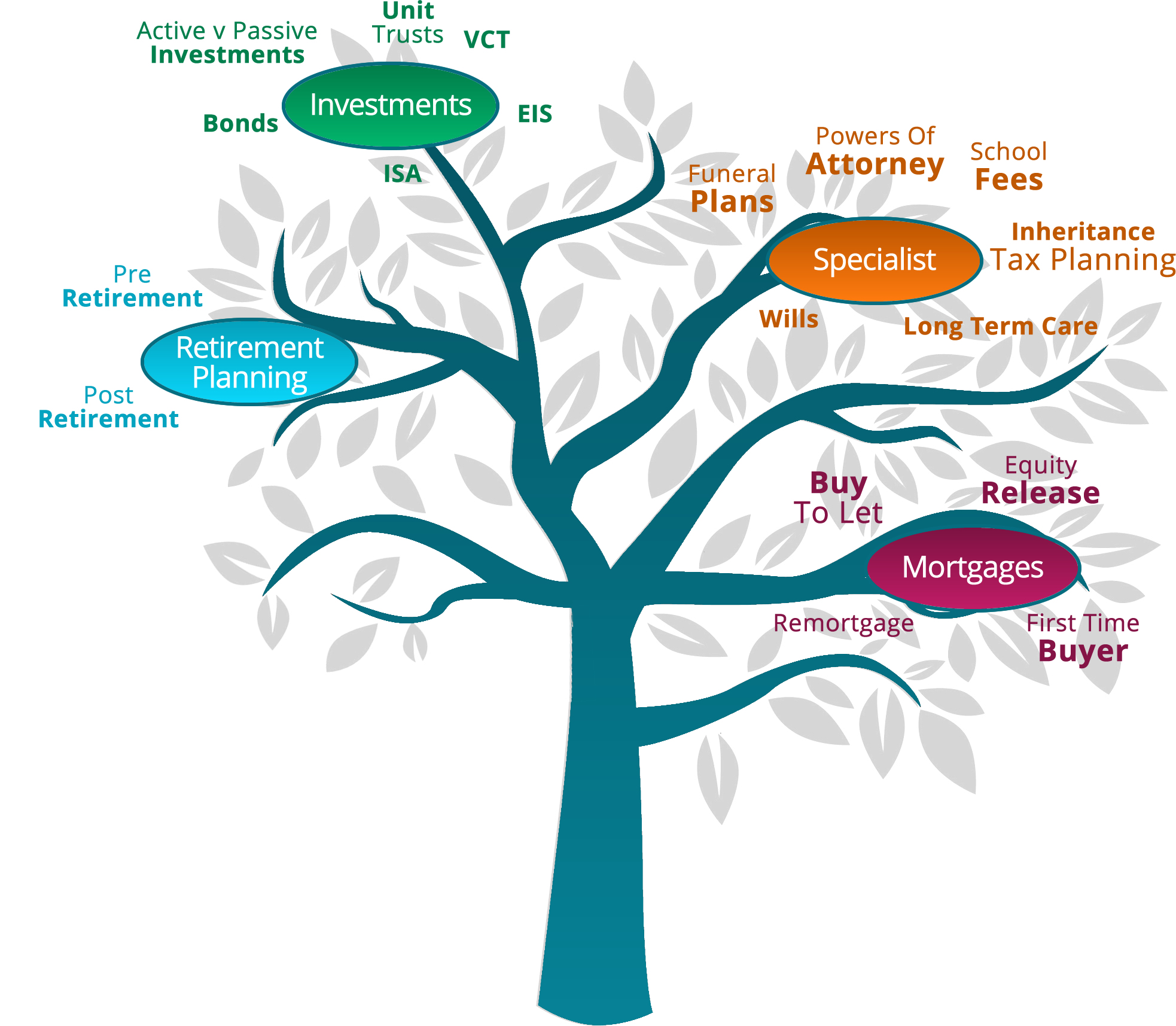

Whether you require a mortgage for a new purchase or need advice about a remortgage we can help:

• Purchase

• Remortgage

• Buy to let

• Commercial

Retirement Planning

Whether you have existing policies in place or not, we are happy to give you an overview of your retirement situation. Although we can advise on all types of pension arrangements, it is often where your money is invested that is more important than which contract you use.

For those who are still saving towards retirement:

• Personal Pensions

• Self Invested Personal Pensions (SIPP)

• Executive Personal Pensions (EPP)

• Retirement Annuities

• Stakeholder Pensions

• Buy to let properties

• Family trusts

For those at the point of taking benefits or in retirement:

• Annuities

• With Profit/Unit Linked Annuities

• Enhanced Annuities

• Income Drawdown

• Phased Drawdown

• Lump sum investments

Again we are happy to review any existing investments you may have free of charge. Many of these types of arrangements are sold through the banks and are often left many years without a review. Depending on your circumstances, some investments may be more beneficial from a taxation point of view than others:

• ISA’s

• Onshore Investment Bonds

• Offshore Investment Bonds

• Collective Investments

• Structured Products

• Cash Management

Regular Saving

If you are looking to invest on a regular basis rather than a lump sum, we can advise on following:

• ISA’s

• Pensions

• Offshore savings plans

• Maximum Investment Plans (MIP)

• Trust Planning

Whatever your financial situation, it is likely that it could be more tax efficient than it currently is. Your personal circumstances will dictate what kind of planning could be utilised:

• Inheritance Tax Planning

• Legacy Planning

• Wills

• Absolute Trusts

• Discretionary Trusts

Meet the Team

With over 50 years of financial services experience and numerous professional qualifications and accreditations, welcome to the HF Wealth team.

Private Clients

We provide advice and guidance to thousands of individuals in the key areas of insurance and financial planning that are so important to their financial future.

How We Work

We cater for wealthy individuals, business owners and high earners and cover every aspect of their financial planning requirements.

"HF Wealth looked after us from start to finish"

"I have no hesitation in recommending HF Wealth"

"HF Wealth showed me how to maximise the returns on my accumulated profits in a tax efficient manner"

"The claims handling and overall service has been first class each and every time."

"I can strongly recommend them to any business that requires a top level of service"

"They have always looked after my interests and I would not hesitate to recommend them to anyone"

"I always receive a friendly and helpful service"

"I receive a review on a much more regular basis which provides me with peace of mind and trust in my adviser"

"As a result of the advice we were given we saved a small fortune"